Heading 2

Paragraph and text

Heading 3

More text and paragraphs

Conclusion heading

Conclusion text

Plain heading change after

Plain text don’t change

Paragraph and text

More text and paragraphs

Conclusion text

Plain text don’t change

If you’ve ever seen a photo of a Lykoi cat, you might have thought it walked straight out of a Halloween movie. Nicknamed the “werewolf cat”, this rare and fascinating breed has captured attention worldwide with its unusual coat and mysterious charm. While their looks are striking, caring for any rare breed means extra consideration. So, having pet insurance in place can help you manage the unexpected.

RELATED: TOP 5 RAREST CAT BREEDS IN SOUTH AFRICA

The Lykoi is a relatively new discovery, first recognised in the early 2010s. Unlike designer crossbreeds, the Lykoi’s appearance stems from a natural genetic mutation affecting their hair follicles. They earned the spooky nickname of “werewolf cat” thanks to their patchy coat and intense, golden eyes. Their partial hair coverage gives them a scruffy, mid-transformation look, which appears perfectly wolfish without a full moon in sight.

Wondering how to say it? The word Lykoi is pronounced “lie-koi”. It comes from the Greek word lykos, meaning “wolf.” The breed originated in the United States when breeders noticed a unique pattern in feral domestic shorthair cats.

Lykoi cats are medium sized with lean, athletic bodies. Their coats are typically a mix of black and white, often referred to as “roan.” Some may look nearly hairless in certain patches, which can change throughout their life.

Unfortunately, no. Like most cats, they produce allergens in their saliva and skin oils, which can still trigger reactions. However, their thinner coat may slightly reduce the spread of allergens compared to fluffier breeds.

Despite their “wild” appearance, Lykoi cats are gentle, intelligent, and playful. They’re often described as dog-like in their loyalty, following their humans from room to room.

Most Lykoi cats bond closely with their families but may be cautious around strangers. They usually get along well with other cats and even dogs, provided proper introductions are made.

A balanced, high-protein diet supports their active nature. Because of their coat, they can be more sensitive to temperature extremes. Consider pet sunscreen or shade in hot weather, and cosy spots in winter. Regular vet visits and cat insurance are essential to cover unexpected health issues.

The Lykoi cat isn’t for everyone, but for the right household, they bring endless fascination and affection. Their wolfish charm is balanced by a sweet, people-oriented personality, proof that looks can be deceiving.

If you’re considering adding a rare breed like the Lykoi cat to your family, make sure you’re ready for the commitment. And don’t forget the practical side: having pet insurance gives you peace of mind when caring for such a unique cat. At dotsure.co.za, we understand that extraordinary pets deserve extraordinary care. Ready to learn more? Contact us today!

South Africa’s road accident stats are so much more than numbers on a page. They’re reminders of the everyday risks we all face when we sit behind the wheel. Our roads are dangerous enough. Now add some students coming home from a party or a few quick glances at some WhatsApps in peak-hour traffic, and you’ve got a recipe for disaster and devastation. Let’s unpack our road accident stats and how to stay safe on Mzansi’s roads.

While you can’t always predict what other drivers will do, you can ensure you’re protected with comprehensive car insurance. Chat to us or get a quote today!

Every year, on average, 14,000 people lose their lives on South African roads.

And the scary truth is that it’s not the roads or the cars that are the problem; it’s how we drive. “South Africa has some of the worst road traffic injury statistics in the world,” says Arrive Alive. “Each year, millions of people are killed or injured on our roads.”

Alcohol remains the biggest villain on our roads, linked to approximately 65% of fatal crashes. Even just one drink slows your reactions and clouds your judgment. The idea of “just one” isn’t harmless; it’s dangerous.

You wouldn’t close your eyes for 10 seconds while driving. Yet that’s precisely what happens when you look at your phone while going 120 on the N2… You’re effectively driving blind for let’s say 100 metres. No meme or group chat is worth the crash caused by texting while you’re driving.

Studies show fatigue can be as impairing as alcohol. Long stretches of road, late nights, or certain medications can cause “microsleeps” where you lose focus for just a few seconds… and that’s all it takes.

It’s when your brain flips rapidly between being asleep and being awake. The episodes last only a few seconds, and often, you aren’t aware of them. These brief and involuntary periods of sleep can lead to a loss of control and potentially fatal accidents,

Behind every statistic is a person with a name, family, partner, or friend, forever changed. Cause of death statistics point mainly to drunk driving, distraction, and fatigue, but the truth is that these high numbers are preventable.

And it’s not only drivers who suffer. Passengers, especially children, are at risk too. Car seat death statistics show just how vital proper restraints are. A poorly fitted seatbelt or skipping a child safety seat can mean the difference between life and death in a crash.

Data also reveals that approximately 35-40% of road deaths in SA are pedestrian deaths. That’s right. Innocent pedestrians are a part of these scary road accident stats, too.

Yes, the road accident stats in SA are scary, but the good news is that we can change them. Every time we choose to drive sober, rest well, and keep our eyes on the road, we’re lowering those numbers. Insurance can help too.

With dotsure.co.za car insurance and the Smart Driver Programme, we’re encouraging a generation of smarter drivers who make smarter moves behind the wheel and are rewarded! You want to know more? Contact us and ask our friendly consultants about game-changing cover.

Artificial Intelligence (AI) is no longer just a buzzword. It’s reshaping industries, including insurance, in ways we couldn’t have imagined. At dotsure.co.za, we’ve embrACEd this future with Ace, our AI-powered chatbot designed to simplify your insurance journey. Whether you’re changing personal information, managing your policy, or submitting your claims, Ace is here to help!

RELATED: HOW DOTSURE.CO.ZA BECAME SA’S FIRST E-COMMERCE INSURER

Ace is your digital insurance assistant. Built on conversational AI, Ace can handle everything from viewing and updating your personal information to giving you instant access to your policy details, debit history, or claims. Basically, it’s an insurance expert in your pocket.

Fun fact: Ace is always learning. With generative AI and integrated FAQs, it delivers accurate, real-time answers to your questions.

AI is revolutionising the way insurers serve customers. From tracking claims processes to detecting fraud and predicting risks, AI improves efficiency, reduces costs, and enhances client satisfaction. For example:

Say goodbye to lengthy forms and waiting for responses. Conversational AI makes it easy for clients to get what they need quickly and in plain language. With Ace, you can:

Ace will also direct you to a human if it cannot execute your changes directly!

Generative AI (like Ace’s underlying technology) can answer complex questions, summarise policy documents, and even predict what information you’ll need next. It’s proactive, not just reactive. Imagine Ace alerting you to upcoming debit days or suggesting the right cover based on your vehicle or pet’s needs. Crazy, but that’s the power of Gen AI.

Claiming has always been a big pain point in insurance. AI removes unnecessary delays by:

AI bridges the gap between client expectations and traditional insurance.

For dotsure.co.za, AI allows us to deliver transparent and personalised cover while reducing operational costs, which directly impacts policy pricing.

Ace is just the beginning of how dotsure.co.za and AI are transforming the insurance industry. From car insurance to pet and motor warranty cover, we’re building a fully digital experience that’s faster, friendlier, and designed for you. Ace will continue to evolve, helping you to manage everything instantly.

Chat with Ace right now online or via WhatsApp and see how easy insurance can be.

At just under two years old, Winston, once a mischievous pup known for his cheeky bark and love of bucket-chasing, has officially graduated as a guide dog. Trained by the South African Guide-Dogs Association, Winston has been paired with Luwie, a seasoned handler who has welcomed him as a working partner, as well as family.

“I don’t see myself without a guide dog any longer,” says Luwie, who has been partnered with five guide dogs since 1994. “Since receiving Winston, I’ve been able to do everything myself again. He’s changed my daily routine completely. We bonded within a week, and now we’re just going strong.”

Winston’s transformation didn’t happen overnight. Like many guide dogs in training, he began his journey bursting with energy and a strong personality, traits that initially made focus a challenge. “He was actually quite naughty in the beginning,” laughs Megan Reid, a trainer at the Guide-Dogs Association. “He was more interested in playing than working, and he’d steal anything he could find. But he’s incredibly food-motivated, and that helped us build trust and teach him the skills he needed.”

The breakthrough moment came during a blindfolded test walk. Megan mistakenly believed they had reached a turning point in the route, but Winston refused to turn. “Despite my insistence, he held his ground. He knew the route better than I did. That was the moment I knew he was ready.”

The warmhearted path of assistance dogs highlights the extraordinary dedication and training involved in matching the right dog with the right person. These partnerships restore independence and quality of life. As Luwie shares, “Winston is sociable, friendly, and incredibly helpful. He even keeps my wife company and occasionally steals her buckets!”

At dotsure.co.za, we’re proud to support this incredible and essential work, by helping to fund guide dog training and cover more than half of the Association’s monthly vet bills. It’s all part of our mission to provide Soft Landings, not just for pet parents but for overall animal welfare.

The impact of professional pups like Winston ripples through families, communities, and hearts. And because all pets deserve protection, dotsure.co.za pet insurance also covers service dogs. Whether they’re chasing buckets or guiding the way, we’re here for them, wholeheartedly.

From kitten zoomies to cozy senior snoozes, every life stage of a cat is filled with charm. But as pet parents, it’s natural to wonder: how long do cats live? The good news is that with the right care, and a little help from things like pet insurance to manage the vet bills, many cats are living longer, healthier lives than ever before.

On average, domestic cats live between 12 and 18 years, but it’s not uncommon for well-cared-for indoor cats to reach their early 20s. The oldest recorded cat, Crème Puff, made it to an incredible 38 years!

Indoor cats tend to live longer than outdoor cats due to fewer risks such as traffic accidents, infectious diseases, and predator encounters. Breed and genetics also play a role, as some breeds such as Siamese and Russian Blues are known to age gracefully.

Cats are generally considered “senior” from around 11 years old, and “geriatric” once they reach 15+. But don’t be fooled, many senior cats remain playful and active with the right support.

Forget the “seven-year” rule; it doesn’t really apply to cats. Here’s a better guide:

So, if your kitty is 6, they’re roughly 40 in human years. Right in their prime!

RELATED: HOW TO CALCULATE DOG YEARS

Your cat deserves a joyful life too. Daily play, affection, and a stress-free environment can significantly boost their wellbeing.

A bored cat can become a destructive or depressed cat. Keep them mentally sharp with:

Older cats especially benefit from gentle brain teasers and simple activities that don’t require too much jumping or agility.

High-quality food that suits your cat’s life stage is one of the best ways to extend their lifespan. Senior cats may need specific diets to support joint health, weight management, or kidney function.

Regular vet check-ups (at least once every 6 months, or more for older cats) are crucial. Vaccinations, dental care, and parasite prevention can all prevent health issues before they start.

RELATED: HUMAN FOODS CATS CAN AND CAN’T EAT

Many cultures believe cats have multiple lives. This myth comes from their amazing ability to escape danger, twist mid-air to land on their feet, and generally bounce back from things most animals couldn’t.

An old English proverb sums it up nicely: “A cat has nine lives. For three he plays, for three he strays, and for the last three he stays.” It’s a poetic way of describing their life stages. From wild youngsters to wise old snugglers.

At dotsure.co.za, we understand that every whisker and tail flick matters. That’s why we offer flexible, affordable pet insurance for cats that helps you manage vet costs and focus on making memories.

Contact us today to explore our cat-friendly plans and see how we can help your pet thrive at every age.

Are you looking for the safest cars for women in South Africa? We’ve done the digging, checking NCAP crash ratings, local trends, and driver feedback, to bring you a list of the top cars designed to keep you confident and protected behind the wheel.

Safety is about more than just airbags and crash-test ratings. It’s also about making sure you have reliable motor warranty cover to keep repair costs from catching you off guard.

While avoiding bad driving habits is vital, having a vehicle with top-tier safety features can be a real game-changer. Plus, we know the road conditions in South Africa can sometimes be anything but safe. The best cars for women often come with:

The Corolla Cross earned a 5‑star Euro NCAP rating, with 85% for adult protection and 83% for child passengers. It’s compact enough for city driving but still has all the smart tech you want, such as lane-keeping assist and automatic emergency braking. Plus, Toyotas are known for affordable parts and great resale value.

Another 5-star safety champ, the RAV4 is perfect if you want something bigger but just as reliable. It’s packed with advanced driver assistance features and offers great all-round protection. It’s ideal for women who want a family-friendly SUV that’s easy to handle.

Both solid picks in the mid-size SUV space. They include safety features such as lane-keeping, AEB, and blind-spot monitoring as standard. They are also known for their strong crash test results overseas and come with competitive pricing.

The Mazda CX-60 is a newcomer to South Africa, but it’s already making the list with its 5-star Euro NCAP rating: 88% for adults and 91% for child passengers. It’s a great choice if you want something modern, and safe.

The VW T-Cross offers a smart balance between affordability and safety. It’s a popular choice for women who want a compact car with a strong safety record. The Polo Vivo, while not as highly rated as the T-Cross (4-star NCAP rating), remains a favourite for its practicality, solid build, and great handling. Plus, it’s perfect for tight parking spots!

For those looking for a car where luxury and safety meet, Lexus models are worth every rand. Both the RX and NX hold 5-star Euro NCAP ratings, with some of the highest safety scores for adults and children.

RELATED: THE TOP INSURED CAR BRANDS IN SA

When shopping for the best cars for women in South Africa, look for:

RELATED: HOW TO AVOID CAR THEFT

It’s all about your lifestyle. City drivers might prefer a compact model like the T-Cross, while families may lean towards a RAV4 or CX‑60.

Pro tip: Pairing the right car with dotsure.co.za Motor Warranty means you can enjoy every drive without stressing about unexpected repair bills!

If you’ve just upgraded and are already a dotsure.co.za fan, head to the Manage Portal and update your car details.

RELATED: ARE ASIAN CAR BRANDS CHANGING THE GAME IN SOUTH AFRICA?

Choosing the safest cars for women is just one part of the journey. Making sure your car is protected from expensive mechanical failures and surprise breakdowns with a motor warranty from dotsure.co.za is the other. Whichever vehicle you choose, make sure its parts are covered too.

Get a quick motor warranty quote online and keep both you and your car safe on the road.

Kennel cough is one of the most common reasons dogs end up at the vet, particularly after a visit to the groomer or a stay at a boarding kennel. We chat to Dr Gerrit Scheepers from Phalaborwa Animal and Bird Clinic about recognising, treating, and preventing kennel cough.

As always, keeping your pet healthy starts with proactive care, and pet insurance helps make that care more affordable when you need it most.

Dr Gerrit Scheepers is a dedicated vet practicing in Phalaborwa, Limpopo, where he runs a dynamic mixed-animal clinic with a wildlife extension. “We do large and small animal medicine,” says Dr Scheepers. “Our practice has a special interest in advanced orthopaedical and general surgery, as well as wildlife darting, treatment, and relocation. We’re even involved in the legal dehorning and movement of endangered rhinos.”

He’s also a proud pet parent to two cats. Bella, a confident 6-year-old female, and a newly adopted fluffball kitten named Katryn.

“Kennel cough, or Canine Infectious Respiratory Disease Complex (CIRDC), is a highly contagious upper respiratory tract infection. It spreads quickly in places where dogs are housed or interact closely, such as kennels, shelters, and grooming salons.”

“The symptoms can vary from mild to severe, depending on the dog’s immunity and vaccination history. The most obvious symptom is a dry, harsh cough that may sound like gagging. You might also notice sneezing, nasal discharge, occasional white foam vomit, and general lethargy. Some dogs will still eat and appear alert, while others may worsen as the disease progresses.”

“Yes. Young puppies under six months and elderly dogs are more vulnerable. Brachycephalic breeds, like Pugs, and toy breeds such as Poodles, Yorkies, and Pomeranians are also more prone to respiratory issues. But ultimately, any unvaccinated dog can get kennel cough.”

“It’s not easy for pet parents to tell the difference between kennel cough, allergies, or other respiratory infections. Many of the symptoms overlap. That’s why it’s important to visit your vet for a thorough health examination. We also use the pet’s history and, if needed, allergen elimination trials to rule out other causes.”

“Mild cases can often resolve on their own within 7 to 14 days, but supportive care can definitely help. Things such as cough suppressants, rest, humidifiers or nebulisation, and plenty of fluids. If your dog is severely affected, they may require isolation, hospitalisation, IV fluids, antibiotics, and even oxygen therapy.”

“Be a responsible pet parent. Kennel cough is preventable. Vaccinate your pets and limit their exposure in high-risk areas.”

Unexpected vet visits can be stressful, not just for your pet, but for your budget. From coughs to complex treatments, dotsure.co.za can help you care for your furry family members. Need help or have questions about our pet policies? Contact us today!

More Expert Vet Advice:

EXPERT VET TIPS FOR FOREIGN BODY OBSTRUCTION IN DOGS ; VET ADVICE: SIGNS OF SEPARATION ANXIETY

Sure, the official road laws matter. But let’s be real. Experience has taught us a few unwritten road rules that every female driver in South Africa should know.

Another safety rule you shouldn’t skip: Game-changing car insurance from dotsure.co.za. Get a quote online or contact us today for more information.

We all know these ones: buckle up, keep your doors locked, and stay alert. But here are the tips you should drive by:

A dead phone means no Google Maps, emergency calls, or live location sharing.

Avoid stopping at deserted petrol stations.

If possible, stick to main roads and skip the shortcuts through poorly lit or quiet areas.

Ladies, we know you know these unofficial road rules:

It’s an unwritten rule amongst all females: If it’s after 21:00 and there’s no traffic, we slow down, check our surroundings, and keep moving cautiously.

If we feel something’s off, we drive off. It’s not that we don’t want to help or can’t help; it’s that we know better.

Women always choose well-lit areas near entrances, and if there’s a camera or security guard nearby, that parking spot gets bonus points.

There will always be a safe gap from the car in front. It doesn’t matter if we are in a rush or in traffic; that gap is there just in case we need to drive off quickly.

RELATED: FUNNY SOUTH AFRICAN DRIVING LAWS: THE UNWRITTEN ROAD RULES

Here are a few apps and features every woman driver should know about:

Our Top Tip: If you’re meeting someone or heading somewhere unfamiliar, always send your ETA to a friend or family member

The thing is, no matter how careful you are, the road is unpredictable. Accidents and theft happen. While these unwritten road rules can keep you safe, dotsure.co.za car insurance can keep your savings secure.

Get a personalised quote today or contact us for more info.

If you’ve ever scrolled past a video of an adorably short-legged cat waddling across the room, chances are you’ve already met the Munchkin cat online. Before adding one to your family, remember that even the cutest cats can get themselves into trouble and end up at the vet. That’s where reliable pet insurance can offer peace of mind.

RELATED: TOP 5 RAREST CAT BREEDS

Munchkin cats are most famous for their short legs, which is a result of a natural genetic mutation that affects their bone growth. Despite their size, these cats are anything but limited in spirit. They’re playful, fast, and known for their “ferret-like” scurry.

They come in a variety of coat types, colours, and patterns, and are often crossbred with other cats, resulting in hybrids like the Minskin (Munchkin and Sphynx) and the Napoleon (Munchkin and Persian).

With their growing fame and limited supply, Munchkin cats are considered a premium breed. You can expect to pay anywhere from R10,000 to R30,000 in South Africa, depending on lineage and breeder reputation.

Contrary to popular belief, their short legs aren’t always a health risk. Many live healthy, happy lives. However, they are at a slightly higher risk for spinal problems such as lordosis (excessive inward curvature of the spine) or pectus excavatum (sunken chest).

Caring for a Munchkin cat doesn’t require a special handbook, but a few extra considerations do help:

While Munchkin cats are undeniably cute and charming, they deserve the same love, care, and protection as any other pet. If you’re considering adding one to your home, make sure you’re prepared for both the adorable and the unexpected. With flexible and comprehensive pet insurance from dotsure.co.za, you can protect your cat and your pocket.

Got questions about cover options? Contact us, we’re happy to help!

There’s nothing like a girls’ road trip. Long drives with good music, snacks, and many pics for the ‘gram. So, we wanted to help you with a library of the perfect Instagram quotes for girls’ trips, to go with all those sunset selfies and snack snaps!

While we’re talking about road trips, don’t forget to check your car’s warranty before hitting the N2. dotsure.co.za’s motor warranty keeps your wheels and wallet covered when the unexpected happens.

“Catch flights? Nope, we’re catching sunsets on the open road.”

“No maps, just vibes.”

“Windows down, volume up.”

“Life is better with messy buns, playlists, and road trip puns.”

“We don’t chase boys; we chase scenic routes.”

“Current mood: windows down, hair everywhere.”

“Keep calm and let’s get lost on purpose.”

“The best therapy? A full tank and good company.”

“Let’s wander where the WiFi is weak, but the snacks are strong.”

“Road trips are just cheaper therapy sessions, with snacks.”

“Warning: Unsupervised women on the loose.”

“We’re 98% road trip, 2% knowing where we’re going.”

“On a mission to find the best selfie spots.”

“We didn’t choose the road trip life. The road trip life chose us.”

“Just winging it. Life. Eyeliner. This road trip.”

“Making memories and a few wrong turns”

“If you listen closely, you can hear the sound of us trying to figure out where to eat next…”

“We’re not lost, just ‘locationally’ flexible.”

RELATED: DRIVING CAPTIONS FOR INSTAGRAM-WORTHY ROAD TRIPS

“Life is a highway, and I wanna ride it all night long.”

“I’m on the highway to… coffee and snacks!”

“Baby, you can drive my car.”

“Oh darling, let’s be adventurers.”

“Country roads, take me home.”

“Just a small-town girl, taking a long drive anywhere.”

“Adventure is worthwhile in itself.”

“Only hang around people that are positive and make you feel good.”

“Just grab a friend and take a ride, together upon the open road.”

“We like pina coladas and getting caught in the rain.”

“As soon as I saw you, I knew a grand adventure was about to happen.”

“Road tripping with my ride-or-dies.”

“Friends that road trip together, stay together.”

“Not all girls are made of sugar and spice. Some are made of road trips and snacks.”

“My favourite co-pilot? The one holding the snacks.”

“Good friends never let you road trip alone.”

“Here’s to late-night drives and laughter that makes your cheeks hurt.”

“Real queens fix each other’s hair at red lights.”

“Exploring new places is always sweeter with your favourite people.”

Next time you’re planning a road trip, remember to pack snacks, grab these Instagram quotes for girls, and make sure your car’s covered.

Ready to hit the road? Get a quick quote online today and drive with peace of mind.

There’s nothing like being in a rush, getting into your car, turning the key (or pressing a button), and all you get is a sad clicking sound. Now you’re sitting there with a flat battery and no idea how to jump-start a car or travel back in time to the moment you snoozed your alarm. Don’t worry; we’ve got you covered! Here’s how to give your dead car battery the little jump-start it needs!

RELATED: TIKTOK CAR HACKS THAT ACTUALLY WORK

Park the working car close enough for the cables to reach without the two cars touching. Ensure both vehicles are in neutral, all lights are turned off, accessories are unplugged, and hand brakes are engaged. Turn off both engines.

Pro tip: It is essential to always consult your car’s user manual, as battery specifications can vary between different vehicles.

Once your car is running, keep it running for at least 15 minutes or take it for a spin around the block to recharge the battery. If the battery dies again, you may need a new one.

RELATED: HOW LONG DO CAR BATTERIES LAST?

Now that you know how to bring your car back to life, why not jump-start your cover with an extended car warranty from dotsure.co.za? A flat battery is one thing, but a mechanical or electrical failure could leave you stuck for much longer (and with a pricey repair bill). Get a quote today and drive with a warranty, not worry!

We’re celebrating 14 wonderful years of protecting South Africa’s pets with wholehearted pet insurance! And what better way to mark the occasion than with gift ideas to spoil your favourite family members?

These proudly South African brands are all about wag-worthy treats and tail-thumping happiness.

With stores nationwide and a well-stocked online store, The Queen Pet Shop offers everything from premium food and grooming gear to fun toys and stylish accessories. It’s a convenient go-to for everyday essentials, offering options for all kinds of pets!

Spoil your pup or kitty with the ultimate in local luxury. Kingsley & Gray Pet Boutique creates handcrafted collars, leashes, beds, and accessories made to order using eco-friendly materials. Each piece is elegant, functional, and bursting with style.

De Lange Bunnies caters specifically to rabbit lovers with pesticide-free oat hay, custom-blended pellets, and chew-safe toys made from untreated apple wood. It’s wholesome, locally sourced goodness for your bun’s belly and teeth.

Bored of bland biscuits? Dog Lick delivers nutrient-rich, dog-friendly peanut butter to use on their lick mats. Packed with collagen, this snack helps with joint care and skin health.

For the pets who love lounging in style, Scruffs offers premium pet beds and accessories that combine softness, durability, and aesthetic appeal. Their beds come in various sizes and styles to suit every breed and space.

Based in Cape Town, Chommies designs vibrant dog accessories that are as joyful as your dog’s personality. Their colourful, handwoven leashes, collars, and toys are made with love and creativity.

Locally made and scientifically formulated, Vondi’s offers preservative-free pet meals packed with real meat, organic veggies, olive oil, and herbs. Their focus on holistic pet wellness helps support digestion, skin, energy, and dental health.

If your dog’s a trail-blazer, South Hound is your brand. Born from exploring South Africa’s great outdoors, their harnesses and gear are built for hiking, swimming, and all kinds of canine adventures.

Pet Heaven stocks over 6,000 pet products online, from toys and food to flea treatments and beds. They deliver straight to your door and make it easy to support pet shelters through optional donations.

Made with human-grade, hypoallergenic ingredients, Mimi & Munch treats are perfect for pets with sensitivities. These wheat-free, preservative-free snacks come in fun shapes and can even be customised for birthdays and gotcha days.

ePETstore is an online hub trusted by South African vets. With expert advice and a wide selection of pet products, this is your one-click shop for nutrition, grooming, toys, and everything in between.

This friendly, family-run business offers a broad range of pet supplies, toys, and food options. Pet, Pool & Home is a community gem for pet parents looking for personal service and affordable local options.

Looking for locally made, planet-friendly pet products? Pawsh & Co handcrafts stylish collars, bandanas, and pet wear using safe, eco-conscious materials. Bonus: You can customise their pieces to suit your style!

There’s no better gift than the peace of mind that comes with dotsure.co.za pet insurance. Our flexible plans cover everything from unexpected emergencies to routine care, so you can focus on cuddles and playtime instead of costly vet bills.

Need help choosing the right plan? Contact us; we’re here to help you and your fur-family live your best lives.

Women in South Africa are constantly multitasking, from running their own businesses to running after their kids. But life can be unpredictable, and that’s where insurance for women steps in, because even the best multitaskers can’t plan for the unexpected.

At dotsure.co.za we have a wide range of cover options designed for women who want reliable, simple insurance. Let’s unpack the 5 essential types of insurance every woman should consider.

RELATED: TYPES OF INSURANCE TO PROTECT WHAT MATTERS

Insurance is about having peace of mind, knowing that if things go wrong, whether it’s a car accident, a break-in, or a health emergency, you’re financially covered and supported. More than that, insurance is empowerment, so you can pursue your goals and take risks knowing you have a safety net.

Whether you’re driving to work, on a road trip with friends, or simply running errands, your car is your freedom. Unfortunately, South Africa’s roads aren’t always safe, with risks such as hijacking and accidents on the rise.

Women need car insurance that offers:

dotsure.co.za car insurance pretty much checks all these boxes. Plus, we make getting cover quick, affordable, and hassle-free.

RELATED: DOES INSURANCE COVER HIJACKING IN SA?

Your car’s manufacturer warranty won’t last forever, and once it expires, a mechanical breakdown could leave you with a huge repair bill. Our motor warranty cover helps with the costs of expensive repairs or replacements, so you can keep your car on the road without breaking the bank.

Your home is where your life happens. Home contents insurance covers everything from your appliances to your favourite handbag in the event of fire, theft, or damage.

Life insurance is about looking after the people who matter most. As the natural caregiver and breadwinner, you want to ensure your loved ones are financially protected if something happens to you. It’s a must-have if you have dependents, a bond, or other financial responsibilities.

Business insurance safeguards your income and assets if you’re an entrepreneur or freelancer. Whether it’s covering office contents, third-party liability, or interruptions, it’s essential for any woman building her empire.

Pet moms, this one’s for you! From surprise vet bills to routine check-ups, dotsure.co.za pet insurance helps you give your pets the best care without worrying about those vet bills.

The best insurance for women offers you flexibility, affordability, and comprehensive protection. With dotsure.co.za, you can get instant quotes online, manage your policies with ease, and enjoy a range of cover options that’s as hardworking as you are.

Do you need a quick quote? Contact us today and we’ll find the right cover for you!

Getting pulled over can make anyone feel like they have broken the law, even if it’s just a routine roadblock in South Africa. If you’re unsure what the law says about your rights when pulled over, let’s unpack what you need to know so you can stay calm, compliant, and confident the next time a blue light flashes behind you.

Pro tip: If you’re insured with dotsure.co.za car insurance, you already have peace of mind when something unexpected happens on the road. If not, maybe it’s time to change that? Get a quick quote right now and then come back to discover your legal rights at roadblocks and routine checks!

In South Africa, you must stop when instructed by a uniformed traffic officer or police official. This isn’t optional. But while you’re obligated to stop, you also have rights to protect you from unlawful treatment.

Pro Tip: If you’re unsure whether it’s a K78, politely ask for the authorisation certificate. Yes, you’re allowed to do that.

RELATED: HOW TO CHECK YOUR DRIVING LICENCE STATUS IN SOUTH AFRICA

They can:

✔ Ask for your driver’s license and car registration.

✔ Issue fines for valid traffic violations.

✔ Impound a vehicle only under certain legal conditions (eg, if the car is unroadworthy).

They cannot:

✖ Demand bribes or cash on the spot.

✖ Search your phone without a warrant or strong suspicion.

✖ Arrest you without cause.

RELATED: WHAT MAKES A CAR UNROADWORTHY? HERE ARE 8 SIGNS

Officers may only search your vehicle if:

If they impound your vehicle, they must give you a written notice detailing the reason.

Roadblocks are there to keep roads safe, but understanding your rights when pulled over can help you avoid unnecessary stress.

Another tip for handling unnecessary stress is knowing you’re protected for the unexpected! Get peace of mind with dotsure.co.za car insurance. Get an instant quote online or contact us today.

From zoomies to full-body rolls and dreamy-eyed bliss, catnip can turn even the most serious feline into a playful kitten. But why do cats like catnip so much? And is it safe for your furry friend to indulge in this green herb regularly?

Just like pet insurance helps cover the unexpected, understanding your cat’s quirky behaviour can help you become a more confident pet parent!

Catnip (Nepeta cataria) is a plant in the mint family, native to Europe and Asia, but it’s now widely grown around the world. What makes it so special for cats is a compound in its leaves and stems called nepetalactone. When cats smell catnip, the nepetalactone binds to receptors in their nose, stimulating the sensory neurons that affect mood and behaviour. The result? A short-lived burst of pure feline euphoria.

The effects are neurological. When the nepetalactone compound hits your cat’s olfactory system, it sparks a reaction in the brain’s amygdala and hypothalamus, areas linked to emotions and behaviour.

This creates a variety of responses, including:

The “high” typically lasts about 10 to 15 minutes. After that, your cat may lose interest until their senses reset.

RELATED: WHY DO CATS PURR?

Yes, in moderation. Catnip is perfectly safe and even beneficial for most cats, as it can:

A small pinch of dried catnip is usually enough. You can sprinkle it on toys, scratching posts, or inside puzzle feeders. Alternatively, you can try:

If your cat has a sensitive tummy or pre-existing conditions, speak to your vet before introducing catnip to their routine.

Just as catnip provides fun and relief, pet insurance provides peace of mind for when life throws a curveball.

Visit dotsure.co.za to learn more about our custom pet insurance plans! Have any questions? Feel free to contact us!

There’s nothing quite like blasting your favourite playlist on a road trip. But sometimes those standard car radios just aren’t doof-doof enough, you know? So, does installing car audio void the warranty on your car? Not always, but it can if you don’t play by the rules.

Your car warranty is there to cover you when certain parts fail or need repairs due to breakdowns or mechanical failures, but aftermarket upgrades like that new sound system can raise red flags. Before you put all your money in the boot of your car, let’s unpack what you need to know.

RELATED: WHICH CAR MODS WILL VOID A WARRANTY?

An extended car warranty usually covers mechanical and electrical failures such as engines, gearboxes, fuel systems, and onboard electronics. However, it doesn’t cover damage caused by aftermarket parts, dodgy DIY installations, or upgrades that compromise your car’s original systems.

So, if that booming subwoofer installation fries your electrical wiring, you could be left paying the repair bill yourself.

RELATED: WHAT DOES YOUR EXTENDED CAR WARRANTY ACTUALLY COVER?

Simply adding an aftermarket sound system doesn’t automatically void your entire car warranty. But, as we mentioned previously, if the installation damages or interferes with the car’s electronics, sensors, or battery, your warranty on those affected components may no longer apply.

Manufacturers and dealers take no responsibility for non-OEM (Original Equipment Manufacturer) modifications. Basically, if they can prove the fault is linked to your new sound system, you’re on your own.

Do you want to keep pumping up the jam and keep your warranty intact? Here’s how:

Dealerships will often charge more for audio installations, but they’ll usually ensure the warranty remains unaffected. Independent installers can be just as good, but the key is finding someone reputable who knows modern vehicles and their complex electronics.

If you go the independent route, ask them directly: “Can you install this without voiding my warranty?” The pros will know how to avoid warranty voids.

RELATED: RMI-APPROVED WORKSHOPS

If the damage was already caused by the installation, removing the system won’t help.

Yes. Documentation helps to prove you didn’t mess with the factory wiring.

RELATED: WARRANTY KNOW-HOW: YOUR MOST COMMON QUESTIONS ANSWERED

To answer the question, “does installing car audio void the warranty?”. Your killer sound system doesn’t have to kill your warranty. Just ensure it was professionally installed and that nothing interferes with your vehicle’s original wiring or electronics.

dotsure.co.za’s extended car warranty is designed to protect your car’s most vital parts. Do you need more info? Get a quick quote online or contact us for more info about how to keep your car parts in tune.

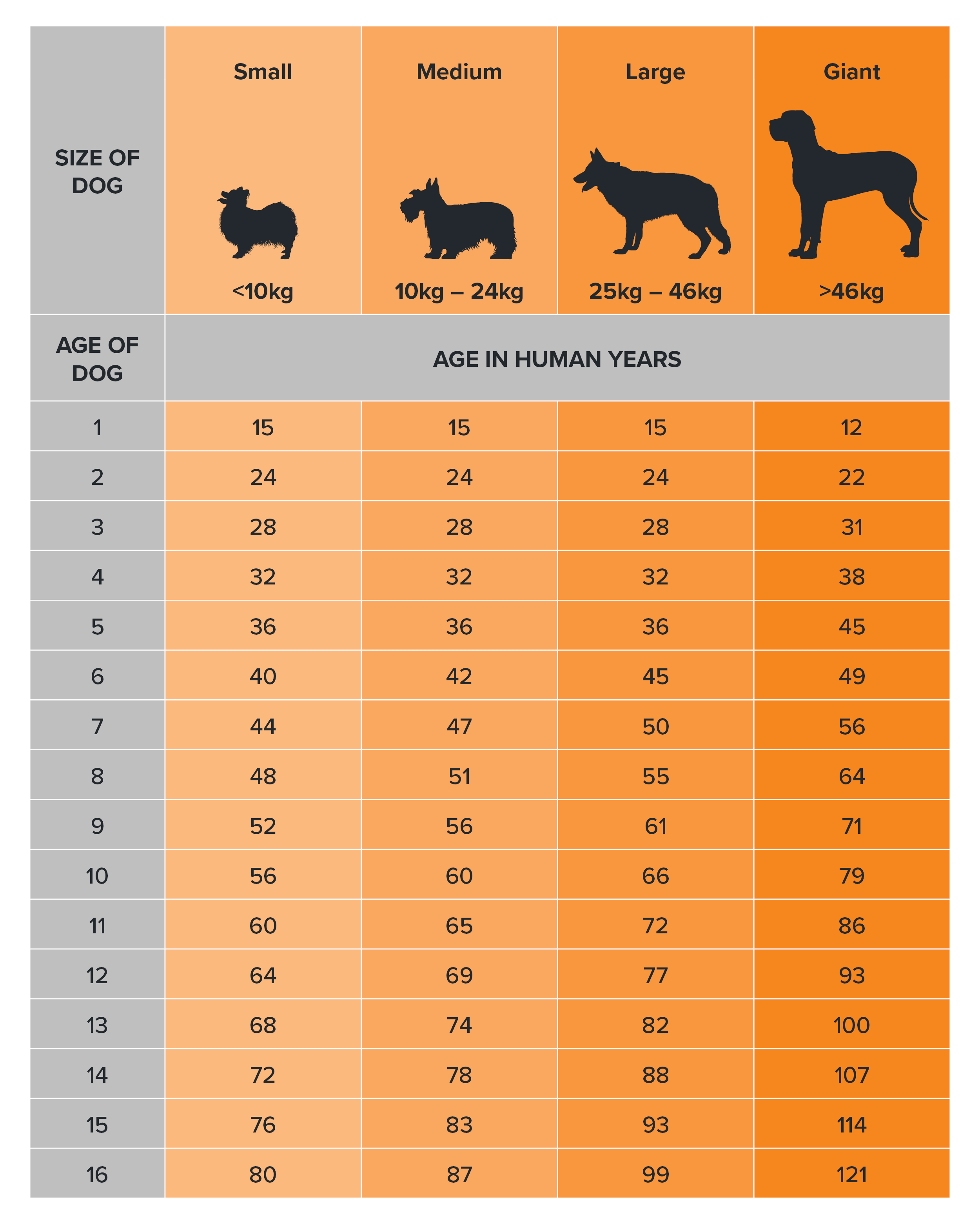

For decades pet parents have followed the old rule that one dog year equals seven human years. While it’s a cute concept, it’s not scientifically accurate.

Understanding how dogs age can help you provide better care, and make more informed decisions about their health, including choosing the right pet insurance. After all, our four-legged companions have different needs at every life stage.

The traditional 1:7 ratio doesn’t take into account how dogs mature. For example, a one-year-old dog is more like a 15-year-old human when it comes to physical and emotional development. In reality, dogs age much faster in their first two years of life. Then the pace slows down, especially for smaller breeds.

How to calculate dog years more accurately:

This approach offers a more realistic view of your dog’s development and health needs.

Bigger dogs grow rapidly, which may accelerate the ageing process and lead to age-related illnesses earlier on. Research shows that for every extra 2 kilograms of body mass, a dog’s life expectancy drops by about a month. That’s why a Chihuahua might live 15 to 20 years, while a Great Dane might only live 7 to 10 years.

RELATED: HOW LONG DO CATS LIVE?

Dogs, like humans, go through defined life stages. Each with specific health and lifestyle requirements:

Rapid growth, high energy, and critical socialisation. Puppies need vaccines, training, and proper nutrition.

Still maturing emotionally and physically. Adolescents may be more independent or distracted. This is a good time for behavioural training and spaying or neutering.

Dogs are fully grown, with established personalities. Keep up with exercise, enrichment, and annual vet check-ups.

You may notice a slight slowdown in activity. It’s time to watch for early signs of joint issues or dental disease.

Seniors may sleep more, be less active, and require a specialised diet or mobility aids.

Dogs in this final stage need regular health monitoring, gentle care, and sometimes assistance with daily activities.

RELATED: STIFF COMPETITION: WHAT IS THE BEST JOINT CARE FOR DOGS?

Here’s a general reference for how dog years stack up by breed size:

Getting older isn’t easy, even for dogs. But with a little extra love and proactive care, senior dogs can enjoy their golden years comfortably.

At dotsure.co.za, we know your dog is part of the family. Want to know how we can support your pet’s health journey? Contact us today to find the cover that fits your dog’s age, breed, and lifestyle.

We’re spotlighting some of the incredible women in motorsports who are transforming the track as we know it! Once seen as a male-dominated lane, motorsports is embracing a dynamic shift where women accelerate change, set new records, and redefine what’s possible when they’re in the driver’s seat.

Maybe you’re not tearing up the track, but your daily drive still deserves winning protection. Get a quick car insurance quote with dotsure.co.za and cruise with confidence.

RELATED: THE SAFEST CARS FOR WOMEN IN SOUTH AFRICA

VW Cup racer Tasmin Pepper has competed on international stages such as the W Series. Not only is she a fierce competitor, but she is also an inspiration for many young women with a need for speed. Tasmin has also coached young Tyler Robinson, who debuted on the karting track at only 9 years old.

Known as South Africa’s fastest female superbike racer, “Nix21” has competed against some of the top female riders from around the world. An adrenaline junkie at heart and an inspiration to young girls across South Africa, Nicole is a rider who proves that if you keep racing for your dreams, you can achieve anything.

The first black female superbike racer in South Africa, Morongoa Mahope aka “Mo83”, only learned how to ride a bike at 30. However, it’s been full throttle ahead ever since, with a fierce determination to prove that motorsport and women do belong together.

Morongoa Mahope and Nicole van Aswegen are also South Africa’s only female superbike racing duo. They have established a non-profit company called Basadi in Motorsports. Their aim? By focusing on rider development and safety campaigns, they’re bringing the world of motorsports to a female audience and creating opportunities for women on the track.

South Africa’s karting prodigy, 14-year-old Emma‑Rose Dowling, recently represented the FIA Women in Motorsports Commission at the 2025 FIA Karting Academy Trophy in Valencia. Racing under the Toyota Gazoo Racing Junior Academy flag, she’s earned podiums in the Rotax Junior MAX series and continues to gain vital experience across Europe.

As a karting champion turned single-seater contender, Chloe is quickly building her profile and filling her trophy cabinet. Her journey illustrates the hard work and dedication of women climbing the motorsports ladder.

At just 17, Durban-born Hannah Lee Daniel races in the national MSA4 single-seater, regional Rotax DD2, and Rok OK-N karting series. Inspired by Formula 1 role models, she focuses on success that inspires other women.

Whether you’re a fierce woman in motorsport or just making school laps, every drive matters! With dotsure.co.za car insurance, we’ll keep you covered at every turn. Do you need some more info? Contact us today and we’ll help you customise your car cover.

Cats might be mysterious, but one thing is certain: they’re always communicating, just not in ways we understand immediately.

Because changes in behaviour can sometimes signal illness or pain, it’s important for pet parents to pay close attention. That’s where pet insurance can come in handy, by helping you stay on top of vet visits if your kitty suddenly becomes unusually vocal or withdrawn.

The soothing sound of a cat’s purr is often associated with happiness, but it can also be more complex than that. Most commonly, cats purr when they’re relaxed or being petted. But they may also purr when they’re scared, in pain, or even during recovery from illness. Vets believe this may be a self-soothing mechanism.

Unlike dogs, cats don’t always wear their hearts on their sleeves. Purring is a more subtle form of communication, often used to bond with humans or seek attention. Kittens begin purring as early as a few days old to let their mothers know they’re okay, and cats often carry this instinct into adulthood with their human families.

Cats use a combination of vocalisations, body language, and behaviour to express their needs and moods.

Understanding feline body language can go a long way to strengthening your bond.

Tail Talk

Eyes & Ears

Touch

Cats may have a reputation for being aloof, but they form strong attachments when they feel safe and understood. Building that trust means learning to read their cues, respecting their space, and responding gently.

If your cat suddenly changes their behaviour, it could signal a health issue. A check-up with the vet is always a good idea, and that’s when having pet insurance from dotsure.co.za can help you manage the costs.

Want to learn more about keeping your cat healthy and happy? Contact us today to explore our cat insurance plans tailored for your companion.

The automobile industry in South Africa is full of revved-up females! Despite the stigmas and stereotypes out there, more and more women leaders in auto repair are showing us that this male-dominated field is no longer off-limits. And, at dotsure.co.za, we’re all about supporting those who drive change.

RELATED: FIERCE WOMEN IN MOTORSPORT

Charmaine Pule is a Director at DME Auto Body Repairs, where she plays a pivotal role to ensure high-quality service and fostering a positive work environment.

“I oversee the team of auto body repair technicians and coordinate their work schedules, assignments, and training. I ensure the team works efficiently to meet deadlines and maintain high-quality repairs.”

“I interact with customers, providing estimates for repairs, explaining the repair process, and addressing any concerns or questions they may have. Maintaining excellent customer service is crucial for customer satisfaction and retention.”

“Safety is a top priority for me. I enforce safety protocols and ensure that all employees follow proper safety procedures to prevent accidents and injuries.”

“I ensure that all tools and machinery are in good working condition and arrange for repairs or replacements as needed.”

“I identify training needs for the staff and provide opportunities for skills development. This includes staying updated with the latest repair techniques, technology, and industry trends.”

“I am involved in business development activities, such as networking with potential clients, collaborating with insurance companies, and promoting the shop’s services to increase business opportunities.”

“Operating as a female in a male-dominated industry, such as auto body repairs, can present several unique challenges. These challenges, I have noticed, arise due to traditional gender stereotypes, cultural norms, and ingrained biases within the industry.

Some of the key challenges I have faced as a female include:

Despite these challenges, I am proudly growing by leveraging unique perspectives, communication skills, and problem-solving abilities in this male-dominated industry. I have vowed to create a supportive workplace culture, fostering diversity and inclusion, and promoting gender equality initiatives that help to address these challenges and create a more equitable environment for all employees.”

“There was a time when I entered a panel shop, and only men were working there. All of them were between the ages of 45 and 70. Only one woman was working there, the cleaner. This is when I decided to follow this career. I was certain that I wanted to alter the perspective. I wanted to make a difference. I tried to influence how people, and especially young people, view the automotive business. I wanted to run a repair shop. In addition, I wanted to support women to become technicians and executives in the car body restoration sector. I wanted to encourage more young people to enter the profession. So, now I am here helping to develop the next generation of automotive leaders, as I believe they will make a positive impact on the industry.”

“For females in the auto body repair industry, pursuing a career in a male-dominated field can be rewarding and challenging. Here are some pieces of advice to help navigate and succeed in this industry:

Remember, your gender does not define your abilities. By staying committed to your goals, continuously improving your skills, and embracing your passion for auto body repairs, you can thrive in this challenging yet rewarding industry.”

Women like Charmaine Pule are proof that the automobile industry is evolving for the better. Whether you’re in the workshop or just on the road, you deserve cover that supports you, too. Get a quick motor warranty quote from dotsure.co.za today and enjoy the ride knowing you’re protected.

Driving with heels may look stylish, but it’s not exactly the safest way to hit the road. Your choice of footwear can make a big difference when it comes to how quickly and safely you can react behind the wheel. So, let’s talk about the risks of driving with heels and which shoes are best for the road.

Driving without car insurance? We’d say that’s pretty dangerous too! Get tailored cover today so that you’re protected on the road!

Technically, yes. It is possible to drive with high heels, but it’s not recommended. Heels can make it harder for you to press the pedals correctly.

Pro tip: Keep a pair of flat shoes or driving shoes in your car and switch out your heels when you get behind the wheel. You can still arrive in style but at least you’ll get there safely.

RELATED: THE UNWRITTEN ROAD RULES FOR FEMALE DRIVERS

The best shoes for driving in South Africa are ones that give you maximum control, flexibility, and grip. Thin-soled sneakers or flat loafers allow you to feel the pedals while keeping your foot steady. Driving shoes made with rubber soles and soft leather are ideal because they don’t slip off.

Your footwear affects your reaction time and control. Shoes with thick soles, heels, or heavy boots can limit pedal feedback. Even flip-flops are risky because they can get caught under the pedal or slip off entirely.

RELATED: IS IT ILLEGAL TO DRIVE BAREFOOT?

Driving with heels is risky business. It’s better to keep a pair of comfy flats or sneakers in your car to swap out before driving. And while you’re thinking about safety, remember that having reliable car insurance from dotsure.co.za is another smart move.

Are you already insured with us? Log in to your manage portal to check your cover or contact us if you have any questions.

South Africa’s demerit system (under the AARTO Act) has been in the works for years, due in part to pandemic delays and legal reviews. While earlier plans set triggers in 2020 and 2021, we now finally have clarity on what’s coming.

Do you need clarity on your car insurance cover with dotsure.co.za? Log in to Manage Portal or contact us and we’ll help you out!

The Administrative Adjudication of Road Traffic Offences (AARTO) Act introduces a demerit point system aimed at disciplining drivers via administrative penalties. This Act decriminalises many minor traffic infringements and shifts the burden off overcrowded courts.

Every South African driver will start off with zero points on their driving licence, and for every infringement, they will gain points according to the severity of their offence.

You could be fined anywhere between 1 point (for example, operating a vehicle with a damaged light) and up to 6 points (for example, failing to stop your vehicle for a traffic officer).

The aim of the game is to keep your points as low as possible, because once you reach 15 points you will be disqualified from operating a vehicle for a specified amount of time.

Your licence is suspended when you hit 15 demerit points, and every point beyond that adds another month of suspension. If you reach three suspensions, your licence will be revoked.

The AARTO demerit system may feel overwhelming, but knowledge is power. Understanding when it will be implemented in South Africa helps you stay ahead.

Do you need car insurance that works with your lifestyle? dotsure.co.za’s Name Your Price™ gives you flexible, affordable cover to protect your ride, whether AARTO is in full swing or not. Get your free quote today!

These clever canines were bred for hunting, tracking, and trailing. Today, you can find many of them tracking down snacks and hunting for the comfiest spot on the couch. Whether it’s a beagle, basset or dachshund, understanding the types of hound dogs and their unique characteristics is key to choosing the right one for your family.

Psst!!! at dotsure.co.za, we offer tailored pet insurance for every hound dog out there! Get a quote and protect your bestie today.

RELATED: UNDERSTANDING BREED STANDARDS

Hound dogs are one of the oldest dog groups in history, with instincts as strong as their loyalty.

Scent hounds such as the Bloodhound or Beagle are built to sniff out everything from missing people to dropped food. Their long ears help funnel smells toward their noses, making them some of the best trackers in the world.

Sight hounds rely on their vision and speed to chase prey with their long legs, lean frames, and fast reflexes. Don’t challenge Greyhounds and Afghan Hounds to a race, they’ll run circles around you!

Small but mighty, Beagles are friendly, curious, and great with children. Their size and playful personality make them one of the most popular hound dog breeds in South Africa.

Fun fact: Beagles are used in pet therapy because of their gentle and affectionate nature!

With their long bodies and short legs, they will charm their way into your heart any day. Basset hounds are loyal, a little lazy, and completely irresistible with their droopy eyes and floppy ears. And, thanks to their powerful nose, they make great detectives should you need one.

Greyhounds are surprisingly relaxed despite their need for speed. They’re quiet, sleek, and love lounging around just as much as they enjoy a good zoomies session.

The ultimate tracker with a sniffer so sharp it holds up in court! Bloodhounds are friendly giants that need space and much mental stimulation.

A fashion icon in the dog world. Afghans are graceful, a little goofy, and very independent. Their silky coat needs heaps of grooming, but their loyalty runs deep. While not the most common hound breed in South Africa, they are known for turning heads worldwide.

RELATED: TOP 5 RAREST DOG BREEDS IN SOUTH AFRICA; SERVICE DOGS: THE IMPORTANCE OF PROFESSIONAL PUPS

There’s no such thing as too many hounds! Here are a few more favourites:

RELATED: TOP 10 MOST POPULAR DOG BREEDS IN SOUTH AFRICA

Caring for a hound dog means keeping their mind and body stimulated.

If you want a loyal, clever companion with a bunch of personality, a hound might be the dog for you. Just be ready for howling, zoomies, and a little stubbornness. Protect them with dotsure.co.za pet insurance, no matter what type of hound dog you choose. From vet visits, illnesses, and accidents, we’ve got them covered!

Get a quick quote online today or contact us for more info.

RELATED:

TOY DOG BREEDS: THE LITTLE PUPS WITH BIG ATTITUDES

HERDING BREEDS: DOGS WITH LEADERSHIP INSTINCTS

Let’s face it: dogs will eat just about anything. Biltong scraps, a rogue carrot, your favourite pair of socks, their own… You get it. If it’s on the floor or within reach, it’s fair game. But when it comes to actual food, some of the human snacks we love can be dangerous for our furry friends. So, knowing the foods dogs should never eat isn’t just useful; it could save your pet’s life.

With dotsure.co.za, those “Oops, my dog ate (insert toxic human food here)” moments don’t have to be so scary. Our pet insurance for dogs helps cover emergency care, from licking up some gauc to ingesting lingerie (yes, this happens)!

RELATED: HUMAN FOODS CATS CAN AND CAN’T EAT

You love your dog like your family, but they can’t exactly eat what is served at the family dinner table. Many of the foods we eat can be toxic to them and cause symptoms such as vomiting, seizures, organ failure, or worse.

Feeding your dog the right food based on their age, breed, and weight is one of the most important things you can do to protect their health. Always consult your vet regarding your dog’s dietary needs.

These are the 15 most toxic foods for dogs, with the reasons why they’re risky:

Chocolate contains theobromine and caffeine, which are stimulants that dogs process much more slowly than we do. The darker the chocolate, the more dangerous it is because of the higher levels of these compounds. If ingested, it can cause vomiting, tremors, and even heart failure.

Some dogs can be more sensitive than others, but even small amounts can lead to sudden acute kidney failure. If you suspect your four-legged friend has eaten some grapes or raisins, contact your vet ASAP.

The thiosulfate in onions and garlic attacks red blood cells, leading to anaemia. They are dangerous whether raw, cooked, or powdered.

Xylitol (found in sugar-free gum and snacks)

This common sugar substitute can cause liver failure, seizures, and hypoglycaemia. Always read your labels and ensure those diet-friendly snacks are out of reach!

Dogs absorb alcohol much faster than we do, so even one sip is dangerous. It depresses your dog’s central nervous system and can cause vomiting, difficulty breathing, and coma.

While coffee, tea, and energy drinks may give you the kick you need to tick off your to-do list, caffeine is the last thing dogs need in their diet. Dogs are much more sensitive to its effects, and consuming it can lead to hyperactivity, seizures, tremors, high blood pressure, and hyperthermia.

The exact reason why macadamia nuts are toxic for dogs is unclear, but these nuts are amongst the top human foods to avoid giving your pup! Symptoms include vomiting, weakness, hyperthermia and depression.

Great for nachos, not great for our furry amigos! The persin in avocados can cause an upset stomach, diarrhoea, and fluid build-up around the heart or lungs in large amounts.

Cooked bones splinter easily, tearing the digestive tract or causing a blockage. Stick to vet-approved chew toys.

Too much fat can lead to pancreatitis, a painful and potentially fatal condition.

Chips, biltong and processed snacks contain too much salt, which leads to dehydration, tremors, and sodium ion poisoning.

Raw dough rises in your dog’s stomach, causing bloating and discomfort. Plus, fermentation can produce alcohol, which we know is super dangerous, too.

Dogs don’t produce much lactase, so dairy often causes bloating, gas, and diarrhoea.

“But that’s what dogs ate in the wild”. We know your dog isn’t hunting for their food like their ancestors. Vet-approved raw foods are A-Okay with us. But some uncooked meat can carry bacteria like Salmonella or E. coli, which means a lot of discomfort for your pup and a hefty vet bill for you.

If it’s not good enough for you, it’s not good enough for them. Mould can contain tremorgenic mycotoxins, which cause seizures.

Top Tip: Print this list and stick it on the fridge for friends, family or visitors to see! It will make everyone think twice about the human foods they share with your dog.

Accidents happen. Sometimes a sausage dog’s short legs are too fast; before you know it, that fallen grape has disappeared! Here’s what you should do right away:

Check the packaging if possible, and estimate how much they ate.

Expert advice is always best. Describe the symptoms, quantity, and food involved and follow their instructions.

Activated charcoal or inducing vomiting might help, but only if directed by a professional.

Contact your vet ASAP if you spot any of these signs after your dog swallows something they shouldn’t:

As pet parents, you know your dog best, so trust your gut and if something feels off, call the vet!

With dotsure.co.za pet insurance, if your dog has taken a bite out of something they shouldn’t have, we’ll help take the bite out of the vet bills in case of emergency treatment!

Here’s how we help:

Do you want to know more about our plans and what we cover? Contact us today and chat to one of our friendly agents! If you already have pet insurance, visit the Manage Portal online and review your policy details to ensure you’re covered.

A few things make the list of foods dogs should never eat. But now you’re equipped with the know-how to keep your bestie safe, and with dotsure.co.za here to help, a backup plan if they ever sink their teeth into something they shouldn’t. Protect them with SA’s #1 Pet Insurer today!

RELATED: HOW TO MAKE LIP-SMACKING HOMEMADE DOG BISCUITS;

THE MOST COMMONLY INGESTED FOREIGN OBJECTS IN PETS

In recent years Asian car brands have gained serious traction in South Africa. These vehicles are becoming top contenders for drivers who want value without compromise. And with so many new models on offer, it’s more important than ever to ensure you’re protected with the right car insurance.

RELATED: TOP INSURED CAR BRANDS IN SA

Once met with skepticism, Chinese cars in South Africa are proving their worth in quality, design, and reliability.

Short for “Build Your Dreams”, BYD is revolutionising the EV market. Its Atto 3 has already made a splash globally and is now available in South Africa, offering an electric driving experience at a competitive price.

Although not officially launched locally, NIO’s buzz in the global EV space is undeniable. Known for its sleek designs and battery-swapping innovation, this Chinese brand could soon shake up South Africa’s premium EV sector.

Geely’s quiet rise is turning heads. With ownership stakes in Volvo, Lotus, and Proton, Geely delivers stylish and high-quality vehicles like the Coolray, already available in some markets.

Already a well-known name, GWM (Great Wall Motors) and its Haval sub-brand are surging in popularity. The P-Series bakkie and H6 SUV have been standout performers, offering both durability and modern tech.

Japanese car brands have long been a staple in South Africa for their dependability and lower maintenance costs.

An all-time favourite, Toyota continues to dominate local sales charts with models like the Hilux, Fortuner, and Corolla Cross. Their balance of reliability and resale value is tough to beat.

Honda cars, such as the Ballade and HR-V, are practical and efficient with a reputation for longevity. Ideal for daily commuters and families, Honda is a quiet achiever on our roads.

Nissan’s Navara, Qashqai, and Magnite bring strong design and innovation to the SUV and crossover market. With local manufacturing and solid dealer support, Nissan remains a dependable option.

For drivers who love adventure, Subaru offers all-wheel-drive performance with models like the Forester and Outback. Known for their safety and handling, they’re a niche favourite with loyal fans.

Cars from South Korea are proving you don’t have to sacrifice style for substance.

Hyundai’s Tucson, i20, and Creta are packed with features that punch above their price range. With long warranties and a reputation for reliability, Hyundai is a strong contender in every segment.

Kia has transformed from budget brand to style leader. The Sonet, Seltos, and Sportage offer youthful flair and comfort, making them popular choices amongst urban drivers.

Genesis, Hyundai’s luxury arm, isn’t yet widely available in South Africa, but the buzz is building. Known for world-class interiors and premium features, Genesis could soon challenge luxury wheels on local soil.

Indian car brands have been gaining momentum in South Africa for several years now, offering affordability and ruggedness that suit local needs.

Tata has long been known for commercial vehicles, but its passenger cars are becoming more refined. With budget-friendly options like the Tiago, Tata appeals to first-time buyers and value-seekers.

Mahindra has earned its place in the local market with the Scorpio-N SUV and Pik Up bakkie. Built for durability, Mahindra’s vehicles are especially popular in rural and off-road applications.

Maruti Suzuki powers many of the Suzuki models sold in South Africa, including the Swift and Dzire. Known for fuel efficiency and easy maintenance, they’re ideal for urban life and tight budgets.

Make sure your trusted ride is backed by insurance you can count on. dotsure.co.za offers customisable car insurance options (with exclusive benefits) to suit your lifestyle.

Thinking of switching? Contact us today, and let’s get you on the road!

Car theft is a growing problem in South Africa. No car, regardless of make or model, is completely immune. With syndicates getting smarter and theft methods more sophisticated, it’s essential to take proactive steps to protect your vehicle. While practical precautions go a long way, having reliable car insurance is essential in case the worst happens.

RELATED: DOES INSURANCE COVER HIJACKING?

South Africa continues to experience high rates of vehicle theft. According to crime statistics, thousands of cars are stolen each year, many of which are never recovered. Whether for illegal resale, parts stripping, or cross-border smuggling, stolen vehicles are in high demand. It’s not just luxury SUVs or bakkies that are targeted. Everyday cars used for school runs or commutes are also on the hit list.

What makes a car a target? Thieves typically go for vehicles that are:

Popular options include steering wheel locks, gear locks, immobilisers, alarm systems, and GPS trackers. Many criminals will move on if they see even one of these installed, especially devices that are visible from outside the vehicle.

Always aim to park in well-lit, secure, and monitored areas. If possible, choose parking spots covered by CCTV or patrolled security. Avoid leaving your car in the same public spot overnight, and try to vary your parking habits to avoid being monitored by syndicates.

A handbag, phone, or laptop bag left on the seat (even if empty) can tempt thieves to break in. Always lock away valuables in the boot or take them with you. Smash-and-grab crimes are a major contributor to vehicle damage and theft.

It sounds basic, but how do you prevent car theft? Start by locking your car, even if you’re stepping away for just a minute. Be aware of remote jamming and always confirm that your car is locked by physically testing the door handle before walking away.

Today’s technology offers drivers more tools than ever before to protect their vehicles. Real-time tracking devices can help you and authorities recover a stolen car faster. Some systems allow remote shutdown of the vehicle, while dash cams with parking mode can act as a deterrent and evidence collector.

Here’s a bonus: dotsure.co.za car insurance includes the installation of a state-of-the-art telematics device by Netstar. This smart system notifies you when entering unfavourable areas, and offers quick access to our emergency line, amongst other benefits.

If your car is stolen:

Acting quickly increases your chances of recovery and smooths the insurance claim process.

Even the best precautions aren’t foolproof. That’s why comprehensive car insurance is essential. It covers theft, damage caused during attempted theft, and other risks such as hijacking or malicious damage.

At dotsure.co.za, we offer customisable car insurance designed to keep you covered when it matters most.

Need help protecting your car? Contact us today, or simply hop online to get a quote!

When it comes to foreign body obstruction in dogs, vets have seen it all! This month, we spoke to Dr Gerna Smit from Hoogland Dierekliniek in Centurion to dig into why dogs swallow the weirdest things, how to handle it when they do, and how to protect your pet (and your bank account) with the right cover from dotsure.co.za.

Foreign body obstruction happens when something your dog swallowed gets stuck in the digestive tract. It’s more than just an upset tummy, and if left untreated, it can become life-threatening. Whatever your dog has swallowed can block their intestines and require urgent medical attention.

RELATED: THE MOST COMMONLY INGESTED FOREIGN OBJECTS IN PETS

“Relatively common”

“A cellphone many years ago, and an Asterix and Obelix toy from a Kinder Joy sweet.”

“Socks, underwear, rope toys, mielie cobs, rubber toys that can be destroyed. The stuffing from soft toys and round pebbles also pose a risk.”

“Take them to a vet and ask them to perform an ultrasound and X-rays.”

“Supply them with safe chew toys and discard damaged toys.”

“There will always be a first time, but often it’s not the last. Some dogs are serious repeat offenders. In Bassets, it’s a stone until proven otherwise. In Bull Terriers, it’s a mielie cob.”

“I have been qualified for 30 years. Always worked in small animal practice with a special interest in medicine. I also have two children and two grandchildren, and I love to cook.”

“My Dad. I also shadowed Dr Humphreys in Somerset West for many years.”

“Mira, Great Dane. 5 years old. Only trusts ladies.

Snippie, Yorkie. 8 years old. Very neurotic.

Kiwhi, Maine Coon. 2 years old. Princess.”

As Dr Gerna Smit said, some pets are repeat offenders, and those vet bills can add up fast! That’s why dotsure.co.za offers tailored pet insurance that can help cover accidental ingestions and emergency vet visits!

Do you need to speak to us? Get in touch or get a quote online in minutes.

We’ve all been there. Your trusty ride starts sounding a bit rough, repairs are getting more frequent, and the fuel bill is starting to feel personal. When you decide it’s time for a new car, the next steps can become overwhelming. For many South Africans, the decision involves affordability, safety, and lifestyle. And yes, that means getting car insurance, too.

Your car needs to take you from point A to B, safely. If it seems like it can’t do that anymore, it’s time to say goodbye.

|

Issue |

What it Could Mean |

|

Frequent, costly repairs |

Your car might be more expensive to maintain than it’s worth. |

|

One major repair (gearbox, engine) costs more than half the car’s value. |

Time to consider an upgrade. |

|

Unreliable starts |

Your vehicle may no longer be roadworthy or safe. |

|

Outdated safety features |

Newer models offer better protection for you and your passengers. |

|

Poor fuel economy |

You’re spending more than you need to every month. |

|

Persistent check engine light |

Something could be seriously wrong under the hood. |

RELATED: SIGNS YOUR CAR IS NOT ROADWORTHY

So, you’ve decided to take the plunge. Great! But before you run off into the sunset with a shiny new set of wheels, here’s where to start.

Remember to factor in the costs of fuel, insurance, maintenance, licensing fees, and potential finance charges. Don’t forget to look at the total cost of ownership, not just monthly instalments.

Do you need boot space for kids and groceries? Or something compact for city traffic? Compare makes, models, and reviews. Keep reliability, resale value, and the service network in mind.

RELATED: HIDDEN COSTS OF CAR OWNERSHIP

Buying your first car? Start here.

South Africans love budget-friendly hatchbacks that still pack a punch. Models such as the Suzuki Swift, Toyota Starlet, VW Polo Vivo, and Renault Kwid are top contenders thanks to their reliability, safety ratings, and affordable running costs.

City drivers might prioritise fuel economy and compactness, while off-roaders and road-trippers might need something tougher. Whatever your vibe, there’s a car that fits it (and your budget).

When you buy a new car, you’ll need to insure it before driving it off the lot (especially if it’s financed). You can usually transfer your current policy or take out a new one altogether.

Your premium will depend on the car’s value, your driving history, where you live, and whether you install any added tech like trackers.

There’s no shame in saying goodbye to your old car. It served you well. But if it’s costing more than it’s worth, compromising your safety, or just no longer suits your needs, it might be time to upgrade.

When you’re ready to hit the road in something new, don’t forget to sort out your cover. Visit dotsure.co.za to get a quick quote, or contact us for help.

RELATED: NEW VS USED CARS

We’ve all seen the videos online: A gobbled-up sock or a swallowed AirPod. Pets ingesting foreign objects is one of the top reasons for emergency vet visits, and they can quickly turn into a serious and expensive situation.

Let’s take a closer look at the most common foreign objects ingested by pets, how to spot the signs, and what to do if your fur child takes a bite out of something weird. And if you’re not already covered, dotsure.co.za pet insurance could take the bite out of those vet bills too!

RELATED: EXPERT VET TIPS FOR FOREIGN BODY OBJECTS DOGS SWALLOW

Small rubber toys, squeakers, bouncy balls, and even toy stuffing are prime suspects that get stuck in your dog’s stomach. Cats aren’t innocent either. Those feather wands and loose strings can all be swallowed, too!

Cooked bones can splinter and cause blockages or internal damage. Foil, cling wrap, and packaging like a chip bag? They might smell like heaven to your pet, but can mean serious trouble inside their digestive tract.

Dogs love laundry day! The random sock or three that didn’t reach the washing line could be hanging out in their tummies instead. And yes, this also happens to cats, especially kittens.

Some dogs love eating rocks. And we will never get it. Others chew on garden branches like it’s their full-time job. These can cause severe obstructions or dental injuries.

Coins, batteries, jewellery, bottle caps, hair ties, earbuds… they’ve all made their way into a pet’s stomach at some point in time.

RELATED: TOP 15 FOODS DOGS SHOULD NEVER EAT

Worried that your pet’s eaten something dodgy? Look out for these signs:

We do not recommend pulling that lacey lingerie out yourself. If you notice any of these signs, call your vet to discuss the best course of action.

Step 1: Try to figure out what they ate and when.

Step 2: Don’t try to make them vomit unless your vet says so.

Step 3: Call your vet and follow their expert advice.

Your vet will either suggest monitoring your pet and waiting until it passes naturally or recommend surgery if it’s dangerous and causing symptoms.

Sometimes, yes. If the object is small and smooth, a vet may suggest feeding high-fibre food to help move things along. But this should never be done without professional guidance. Attempting DIY treatments can make things worse.

Keeping curious mouths out of trouble doesn’t have to be hard:

Try to keep laundry, cables, and small objects out of reach.

Opt for vet-approved, size-appropriate toys that can’t be swallowed or shredded easily.